Just how do PPP funds functions when the care about-operating?

With a bit of research and you will big date, you’re in a position to influence these types of activities yourself. If you’re having difficulties or making reference to an unusual condition, you ought to see your local straight back to own suggestions. Whether you’re happy to pertain or otherwise not, you need to render two years of tax returns, payroll account, judge business pointers, and documentation of exactly how COVID-19 has impacted your organization adversely.

When you find yourself mind-operating the maximum amount you could potentially use with a beneficial PPP mortgage was $20,833. While care about-operating you truly do not have staff. For this reason, your annualized salary is restricted to help you $100,000. The entire number which you borrow is eligible getting forgiveness. To apply for forgiveness, you’ll need to finish the Setting 3508S. For those who have good PPP financing you need to remain track of proprietor payment and expenses. When you sign up for forgiveness you’ll want to prove expenses. When you find yourself applying for an extra PPP loan, try to show a 25% decrease in disgusting invoices. New and you may a quarter when you look at the 2020.

How do i rating that loan for an excellent 1099 income?

Surviving a worldwide pandemic because a 1099 staff could have been absolutely nothing lacking hard for many of us. Which have market uncertainty and you may restrictions modifying apparently, some of us has suffered financial factors. The good news is that every of us accept that the newest pandemic commonly admission and normalcy commonly go back will ultimately. The tough part was keepin constantly your providers alive just like the globe will get straight back on track. If you are a great 1099 individual, you should buy that loan.

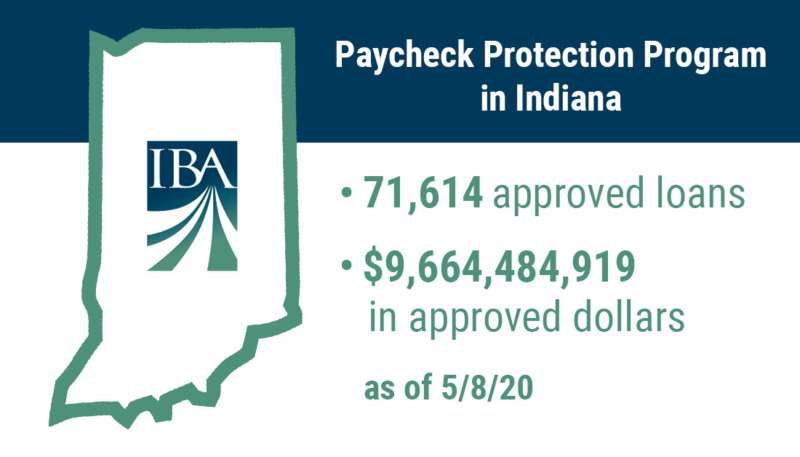

PPP funds are offered for 1099 earnings. If you’re able to plunge from the hoops and you may invest the amount of time to use, you definitely is. PPP fund are made to help worry about-working individuals with 1099 income survive a major international pandemic. However, you will need more than just an excellent PPP loan. Before applying for a loan, you’ll know how much cash money their 1099 claims. Due to the fact a single that have business costs, you truly discount costs. Therefore, the revenues and net income will be different. Because the a great W2 worker, loan providers can get require revenues as they know a highly an excellent imagine away from exacltly what the genuine collect is actually. Although not, as the a 1099 personal, a loan provider get attention on the disgusting and you may net mutual. Sometimes, self-functioning individuals avoid taxes by simply making the expenditures much more than they really was. If you have been doing this it may restrict your own capability to rating a loan.

The newest forgiveness procedure can differ depending on the lender so you should consult your bank

Personal bank loan: If you’re able to prove 1099 money and possess good credit score, you will be in a position to qualify for an unsecured loan. Personal loans provide people with cash. Since the financing is actually funded, you could potentially spend the finance but you have to. If you intend to utilize them for team or personal costs, it’s not necessary to divulge where bad credit installment loans Maryland all the buck goes to new lender. Personal loans offer repaired monthly installments which will make them easy to handle. However, you’ll have to afford the cash back. You should try to score a PPP loan before applying to have a personal bank loan.

House equity financing: you own a property and now have security in it, you may be in a position to be eligible for a home collateral loan. Property guarantee loan can provide a lump sum of money, similar to a consumer loan. The difference between the 2 sort of loans would be the fact one is actually secured of the equity therefore the other isnt. Property security financing need one borrow secured on the brand new collateral of your home. That is high-risk. For folks who default into the a property collateral loan, you risk shedding your home. Before you take property security mortgage, you need to submit an application for an effective PPP loan. Otherwise be eligible for an excellent PPP financing, you should after that imagine a consumer loan prior to a house collateral financing more often than not.